One Stop Income Tax - Book a quote Call (407) 730-2459 Get directions WhatsApp (407) 730-2459 Message (407) 730-2459 Contact us Find a table View menu Place an order

Our vision is to far exceed the expectations of the communities we serve. Comprehensive financing, the name says it all.

One Stop Income Tax

The IRS is handing out $1.5 billion in refunds to people who haven't filed their 2018 federal income tax returns. The April deadline is approaching

Detroit Monthly One Stop Shops Will Offer Health Screenings, Other Resources

Whether you're a tax filing veteran or a newbie, our resources will help you get a head start this tax season.

I had no w2s at all. The man entered my information and said the bank needed time to process my charge and called back 45 minutes later to say the charge was approved. I like this place I will come back

Cash advance "advance." The IRS is not open, but I wanted the caching. It took the guy 15 minutes to enter my information, boom, he got a text and they said I was approved.

I filed my 2016 taxes here because my cousin said there was a cash advance. When I called back the woman who answered the phone said "yes we are charging again" so I will be filing my taxes here again this year. Everyone must make social security contributions based on their income, even those working past full retirement age. Working past full retirement age can also increase future Social Security benefits, since Social Security taxes continue to be paid.

Paying Social Security Taxes On Earnings After Full Retirement Age

However, continuing to work may reduce your current payments, if any, in the year you reach full retirement age, subject to Social Security Administration limits that change each year.

For example, if you reach full retirement age in July, your total benefit income from January through July must be below the limit. Otherwise, Social Security benefits are reduced by $1 for every $3 of earnings over the limit. That's $50,520. $51,960 in 2021 and $51,960 in 2022.

That money is held by the Social Security Administration and is paid back in stages when the taxpayer stops working. No matter how much income you have, there is no limit to how much you can earn after the month you reach full retirement age when your benefits are paid in full.

However, receiving social security benefits while continuing to work can have the unintended negative consequences of hitting taxpayers with higher tax rates. We forget that social security benefits (including half of your social security benefits) can be taxed up to 85% according to your request. status and total income.

Louisiana Accepts 2022 Income Tax Returns Beginning January 23rd

Some states also tax Social Security benefits. You can withhold taxes from your Social Security benefit payments by completing IRS Form W-4V or by requesting a voluntary withholding request form online.

There are currently 13 states where Social Security benefits may be taxable at the state level, at least for some beneficiaries. Live in Colorado, Connecticut, Kansas, Minnesota, Missouri, Montana, Nebraska, New Mexico, North Dakota, Rhode Island, Utah, Vermont, or West Virginia. If so, check with your state tax authority. As with federal taxes, the way these agencies assess Social Security varies based on income and other criteria.

There are several remedies for those who pay taxes on Social Security benefits. Perhaps the most obvious solution is to reduce or eliminate the interest and dividends used in the interim income formula.

The solution, therefore, is to convert reportable investment income into taxable deferred income, such as annuities, which does not appear on the 1040 form until it is withdrawn. If you have a $200,000 Certificate of Deposit (CD) with 3% income, this equals $6,000 per year and counts as provisional income.

Pay No Income Tax Despite Earning Rs. 7.25 Lacs A Year

However, if that same $200,000 is increased within the annuity and the interest is reinvested in the annuity, there is effectively $0 interest reported when calculating interim income.

Whether you are self-employed or employed, as long as you are working and earning an income, you must have Social Security.

However, whether you have to pay taxes on your Social Security benefits depends on your Modified Adjusted Gross Income (MAGI). Benefits are taxable if your MAGI is above certain thresholds for your application status (for example, single or married joint applicants). Up to 85% of a taxpayer's social security benefits are taxable.

In general, pensions are taxable income if distributions by account type are considered. In effect, therefore, an investor who has not used all of the interest paid from a CD or other taxable instrument may benefit from moving at least a portion of their assets to a tax-deferred investment or account.

Tax Withholding Definition: When And How To Adjust Irs Tax Withholding

Another possible remedy, especially if you're at or near the taxable profit threshold, is to simply put in some work.

Notably, 85% of Social Security may be taxable after retirement. Your income at that time determines the taxable amount of your benefits. If you apply as an individual and your income is between $25,000 and $34,000, 50% of your benefits will be taxed. Amounts over $34,000 are taxed at 85% of benefits. If you are married, you must pay 50% tax if your combined income with your spouse is between $32,000 and $44,000. Above $44,000, 85% of profits are taxable.

You will not have to pay Social Security taxes above the 2021 base wage limit of $142,800. Therefore, if you earn more than $142,000, the maximum amount you will pay in Social Security taxes is $8,853.60. If your income is less than $142,000, the maximum amount you will pay in Social Security taxes is less. The base salary cap for 2022 is $147,000.

7.65% in 2021 is the combined rate for Social Security and Medicare. The Social Security portion is 6.2% up to the 2021 salary-based limit of $142,800. The 2022 tax rate remains the same, but the salary-based limit increases to $147,000.

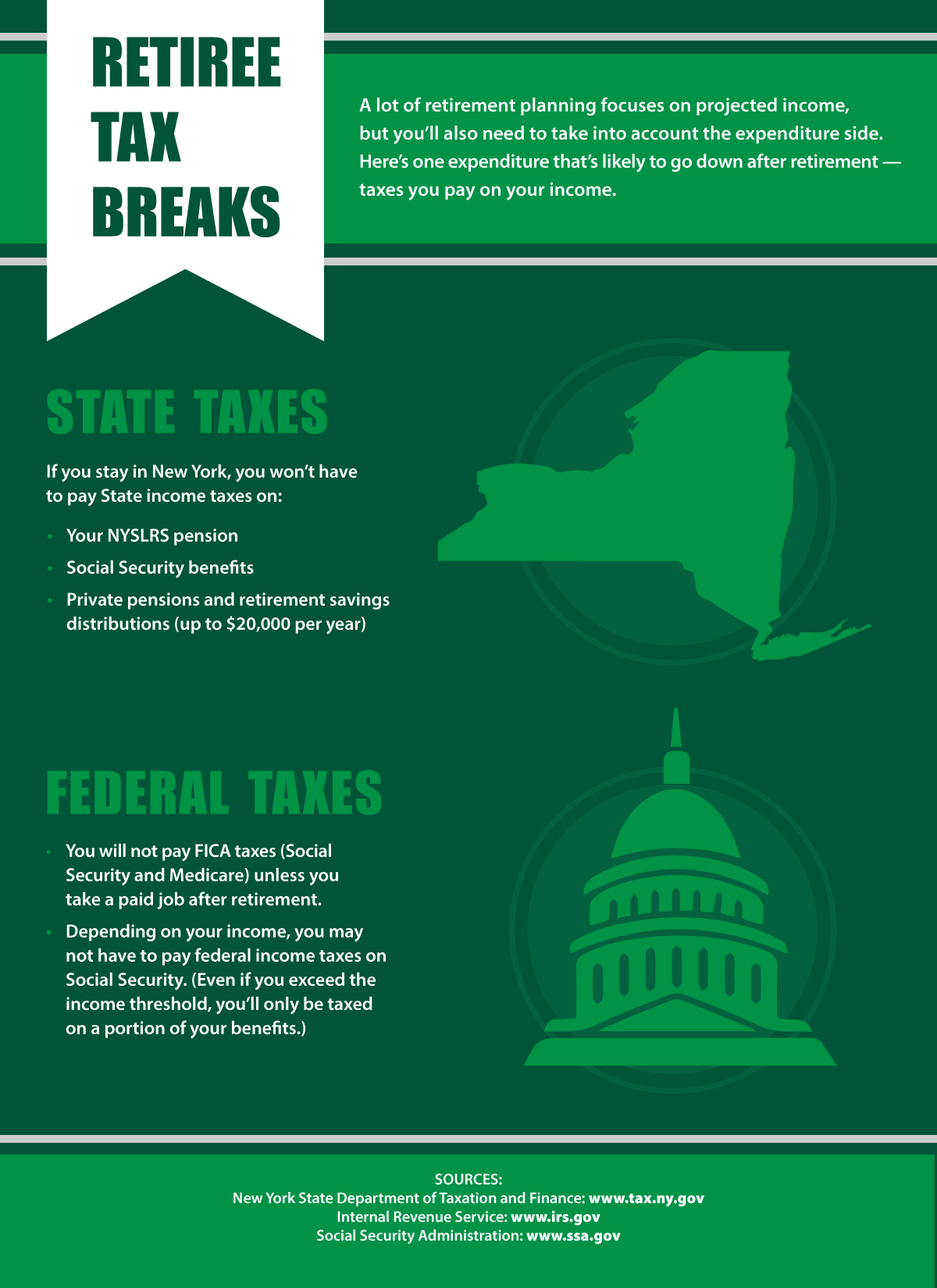

Taxes After Retirement

If you want to continue working after retirement, you will need to enroll in Social Security. Once you start receiving Social Security benefits, you can also pay taxes based on your income. You can pay taxes on 50% or 85% of your benefits. There are many strategies to avoid taxes, such as reducing income, reducing interest income and dividends.

Writers must use primary sources to support their work. These include white papers, government data, original reports, and interviews with industry experts. Where appropriate, we also reference original research from other reputable publishers. Please see our Editorial Policy to learn more about the standards we follow to create accurate and unbiased content.

The offers shown in this table are from paid associations. This compensation may affect how and where your listing appears. Not all offers available in the market are included.

By clicking "Accept all cookies", you agree to the storage of cookies on your device to improve your navigation through the site, analyze the use of the site and assist in our marketing efforts.

Section 139 (8a)

When do you stop paying income tax, age to stop filing income tax, stop paying income tax, stop paying income tax legally, one stop tax, stop income tax, one stop tax services, one stop tax shop, at what age can you stop filing income tax, how to stop paying income tax, stop paying federal income tax, one stop tax review

0 Comments